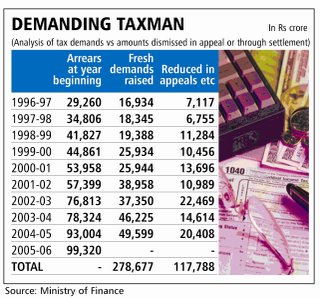

| Over 38 per cent of direct tax demands made by the taxman over the last nine years have been dismissed in the process of appeals against them or through the process of a settlement with the tax authorities. |

| |

| While the tax demand arrears at the beginning of 1996-97 were Rs 29,260 crore, fresh demands worth Rs 278,677 crore were made between 1996-97 and 2005-06 after the taxman scrutinised all the tax returns. |

| |

| Against a total of Rs 307,937 crore of arrears and fresh demand during the nine-year period, a total of Rs 117,788 crore was written off in appeals and/or through settlements with the taxman. |

| |

| While the total demand for additional taxes through the scrutiny process has grown by around 14 per cent annually during this period, the total amount written off (either because it was dismissed or settled) also grew apace. |

| |

| The finance ministry had set up a Task Force on Recovery of Arrears of Direct Taxes in August 2004, and as a result, the arrears collected have gone up to Rs 7,083 crore in 2004-05 against Rs 5,540 crore the previous year. |

| |

| There has also been a drive to dispose of appeals faster, including through settlements — while Rs 20,408 crore of tax demands were written off during 2004-05, the figure for the year prior to this was Rs 14,614 crore. In percentage terms, however, the amount being written off has not shown any major change. |

| |

| While nearly a fourth of all pending demands were written off in 1996-97, this rose to 29 per cent in 2002-03 and then fell to 22 per cent in 2004-05. |

| |

| According to the ministry of finance, which released this information at the Economic Editors’ Conference, of the total arrears of Rs 99,698 crore pending at the end of 2004-05, around 64 per cent is “difficult to recover”. |

| |

| While a total of Rs 27,022 crore is stuck until the Harshad Mehta cases come to a close at the Special Court, another Rs 10,038 crore cannot be recovered because the assessees have either no or inadequate assets. Another Rs 5,486 crore cannot be recovered as the assessees are not traceable, and so on. |

0 Comments:

Post a Comment

<< Home